If anything is causing you confusion or trouble, we want to get to the bottom of it and ensure you are on your way as quickly as possible! We are available by phone or email to address any questions but here are a few common client questions that we can answer for you upfront!

Why didn’t I receive an email?

Here are a few common reasons why emails generally aren’t seen:

- They landed in spam, junk, or social/promotional email folders. Please take a peek in all applicable folders

- Please double check your email address with your vendor. There might have been an inadvertent typo in the address or they may have sent your items to a different email account

- Your vendor can always review the status of documents to ensure they were “sent” and resend!

Why don’t I see fields for me to sign on my contract?

Not to worry, the appropriate fields are there! However, you will only see the interactable fields after clicking the “sign” button (not when just viewing your contract)

How do I link my bank account?

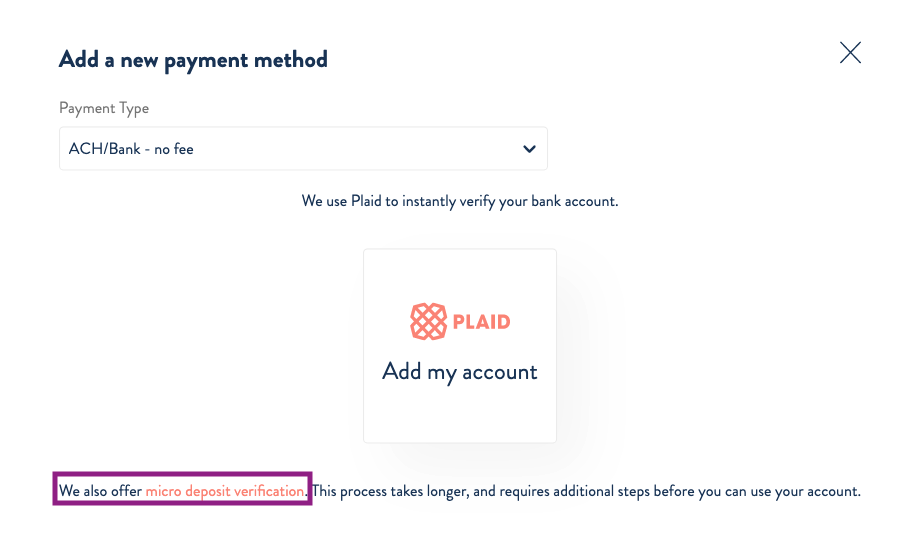

- Most banks and credit unions support plaid (instant) verification. If you don’t see your banking institution in the list, be sure to type it in the search box. If it is not listed, you can link your account manually using the “micro deposit” verification option (image below). Using this method takes an extra business day or two but it is a foolproof way to link any account! You will enter your routing and account numbers, then wait to see (2) micro deposits show up in your account. Once you see the deposits (usually in 1-2 business days), you just need to enter the amounts on your My Wallet page. From there, you are able to make any and all payments!

- If your bank is listed but you are receiving an error, be sure to check your login credentials (user name and password)

Why did I receive a bank (ACH) payment failure?

You will want to reach out to your bank for further information – payment failures are a result of a block by your bank. Generally they are able to resolve quickly so you can resubmit payment. Here are a few common reasons we see for ACH payment failures:

- The account doesn’t support online transactions (certain savings accounts or money market accounts don’t allow for online payments)

- The account has a maximum number of monthly transactions – some institutions only allow for a limited number of online transactions per month

- The transaction is over the daily max withdrawal (many banks have a limit of $1000)

- There are insufficient funds to cover the payment

How do I add another user to my account?

Currently, accounts are limited to one email address and password. However, you can share your login credentials with your partner and anyone that you would like to have access to your account. Note some of the most common features of your account are viewing and exporting documents, signing contracts, securely paying invoices, tracking spending, and inviting vendors + viewing their contact information.